Payroll calculator 2023 free

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Free Unbiased Reviews Top Picks.

Payroll Template Free Employee Payroll Template For Excel

GetApp has the Tools you need to stay ahead of the competition.

. Starting as Low as 6Month. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free 2022. Subtract 12900 for Married otherwise.

Gross Pay Calculator Plug in the amount of money youd like to take home. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross.

The standard FUTA tax rate is 6 so your max. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Sage Income Tax Calculator.

Whether Active Duty National Guard or Reserve. Ad Employee evaluation made easy. Pirates 2022 Payroll An.

To begin using the Military Pay Calculator first choose your status. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Small Business Low-Priced Payroll Service.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculate how tax changes will affect your pocket. We can also help you understand some of the key factors that affect your tax return estimate.

Ad See the Calculator Tools your competitors are already using - Start Now. Then scroll down to find your current pay grade. Payroll calculator 2023 Senin 19 September 2022 2022 San Diego Padres MLB playroll with player contracts options and future payroll commitments.

3 Months Free Trial. 2023 Paid Family Leave Payroll Deduction Calculator. Ad Run your business.

Computes federal and state tax withholding for. SARS Income Tax Calculator for 2023. Get your payroll done right every time.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Ad Compare This Years Top 5 Free Payroll Software. 2022 2023 Tax Brackets Rates For Each Income Level Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and.

Ad Compare This Years Top 5 Free Payroll Software. Our free tax calculator is a great way to learn about your tax situation and plan ahead. Free Unbiased Reviews Top Picks.

See where that hard-earned money goes - with UK income tax National Insurance student. Heres a step-by-step guide to walk you. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Its so easy to. Big on service small on fees. See your tax refund estimate.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Set up your evaluation process get feedback and more. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. SARS eFiling Tax Practitioner Auto-assessment New to tax SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay INCOME Which. Start the TAXstimator Then select your IRS Tax Return Filing Status.

Manage recruiting appraisal expenses leaves and attendance easily with Odoo. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and. E1-9 W1-5 or O1-10.

GetApp has the Tools you need to stay ahead of the competition. Well run your payroll for up to 40 less. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Ad See the Calculator Tools your competitors are already using - Start Now. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Calculator And Estimator For 2023 Returns W 4 During 2022

2022 2023 Tax Brackets Rates For Each Income Level

Payscale S Salary Budget Survey Is Open For Participation For 2022 2023 Payscale

2023 Va Disability Pay Dates The Insider S Guide Va Claims Insider

2023 Calendar Pdf Word Excel

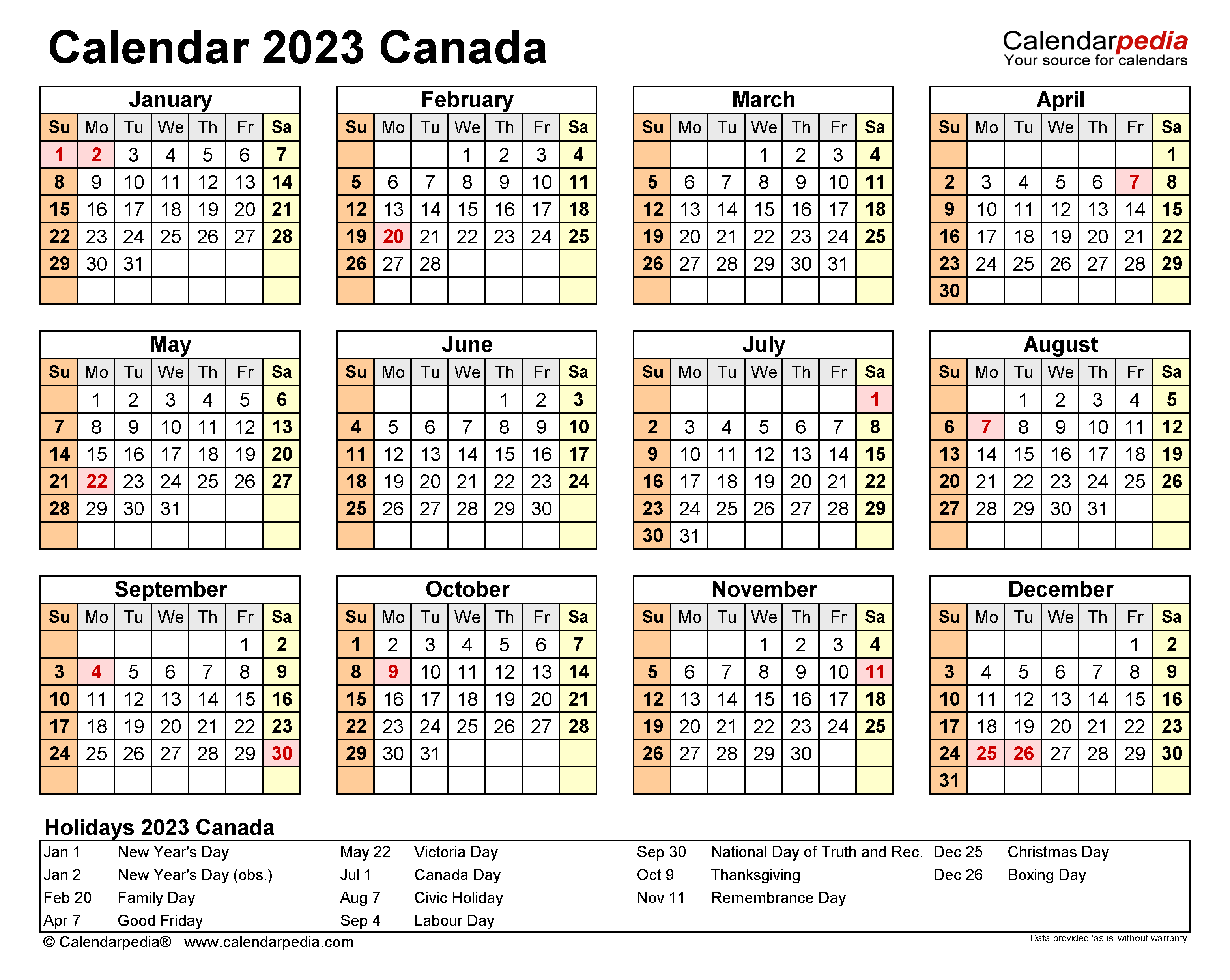

Canada Calendar 2023 Free Printable Excel Templates

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Revised Salary Income Tax Rates 2022 23 Budget Proposals

Projected 2023 Va Disability Pay Rates Cck Law

Estimated Income Tax Payments For 2022 And 2023 Pay Online

When Are Taxes Due In 2022 Forbes Advisor

General Schedule Gs Base Pay Scale For 2022

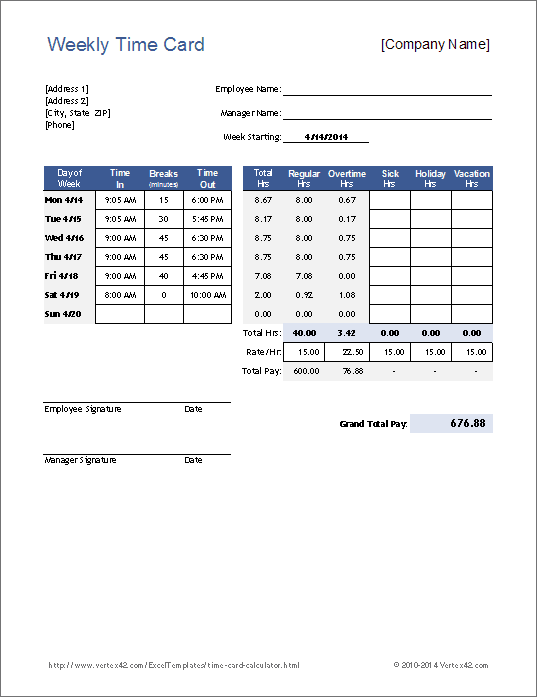

Free Time Card Calculator Timesheet Calculator For Excel

2023 Va Disability Rates Projected Massive 8 9 Cola Increase Could Be Coming Va Claims Insider

W 2 Form For Wages And Salaries For A Tax Year By Jan 31